types of taxes in malaysia

Effective from January 2020. Corporate income tax in Malaysia is applicable to both resident and non-resident companies.

Tax Planning Back To Basics The Edge Markets

For non-residents in Malaysia the income.

.jpg)

. Additionally wages and tips plus self-employed or business income are types of earned income which also need to. Value added taxes excise charges quit rent Goods and Services Tax Service Tax and Sales Tax and other indirect taxes are examples. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

Cukai taksiran is a much more familiar term for this type of tax. Corporate income tax 2. Malaysia Corporate - Withholding taxes Last reviewed - 14 December 2021.

Income tax corporation tax property tax consumption tax and vehicle tax are the main types of taxes and it is better to know the details in order to avoid surprises once there. Basically homeowners will now just pay the tax for their own parcel their own unit. 4 Gratuity paid out of public funds Gratuity paid out of public funds on retirement from employment under any written law.

This rate is relatively lower than what. The classification of Malaysias income tax rate is divided into two. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

Taxable income in Malaysia uses both flat and progressive rates depending on how long the employee will be working there and the type of work theyll be carrying out. These companies are taxed at a rate of 24 Annually. Bonuses do not fall.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. Type of indirect tax. Know why where to study Law in Malaysia.

Type of indirect tax. You will be granted. Start reading Contents 1.

Premium Taxes may apply to gifts and rewards such as vacations vouchers telephones cash laptops or houses. Direct taxes are taxes on profits or. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

An individual will be regarded as a tax resident if he is in Malaysia for at least 182. Inland Revenue Board of Malaysia 7. Individual and the husband wife who elects for joint.

Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. Tax Flyer Tax Preparation Tax Refund Tax Consulting Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

As mentioned earlier stamp duty also imposed on the loan documents if you taking up bank loan to finance the purchase and you have to pay a 05 of the loan amount on top of. Real property gains tax 6. 5 Gratuity paid to a contract officer Gratuity paid out.

Sales and Service Tax 4. Personal income tax 3.

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Income Tax Malaysia 2018 Mypf My

2013 Filing Programme For Income Tax Returns Malaysian Taxation 101

Tax Types Of Tax Direct Indirect Taxation In India

6 Types Of Business Entities In Malaysia Tetra Consultants

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Impacts Of The Self Assessment System For Corporate Taxpayers

Individual Income Tax In Malaysia For Expatriates

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Sst Sales And Service Tax A Complete Guide

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

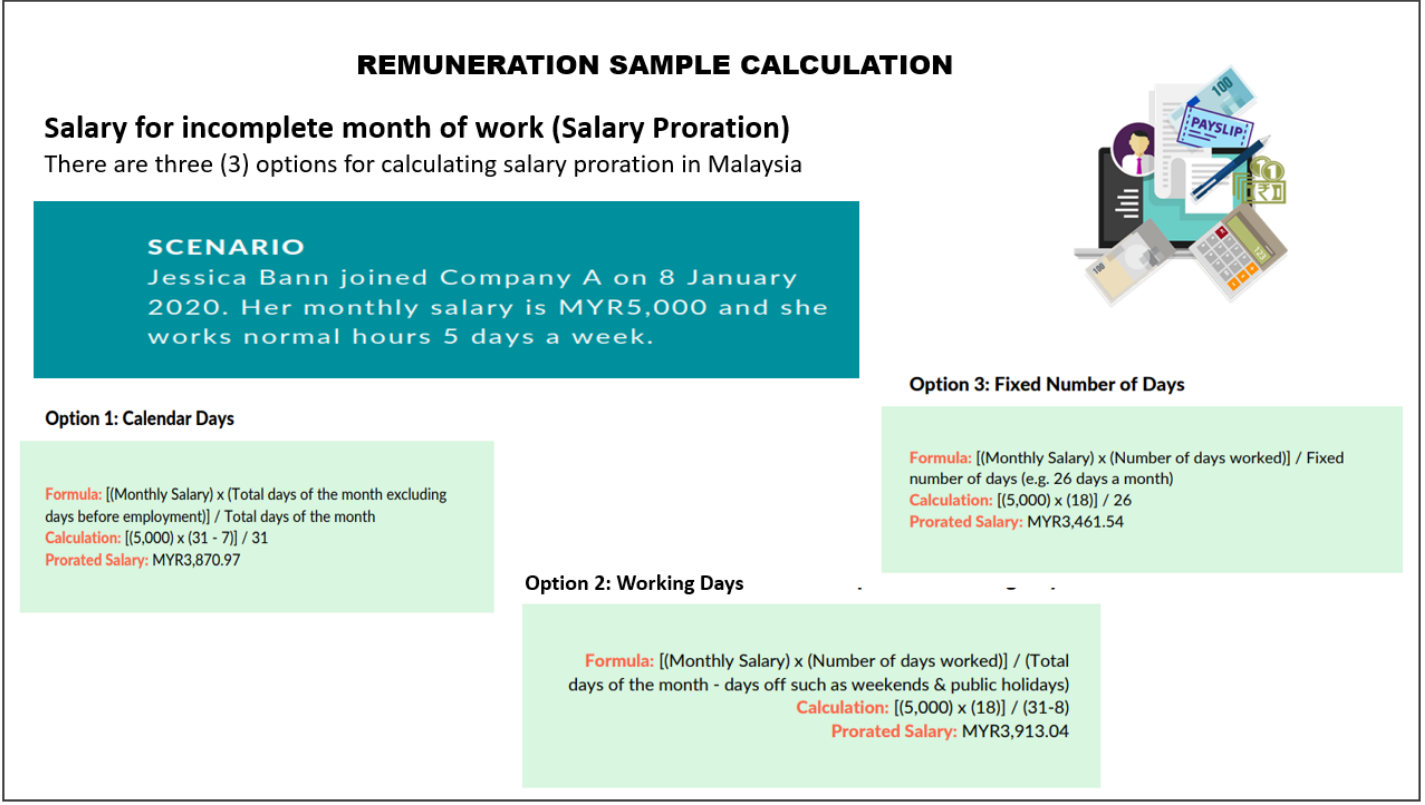

Everything You Need To Know About Running Payroll In Malaysia

List Of Taxes In The Philippines For Local And Foreign Companies 2022

Financing And Leases Tax Treatment Acca Global

.jpg)

Financing And Leases Tax Treatment Acca Global

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

0 Response to "types of taxes in malaysia"

Post a Comment